Trucking company bankruptcies in 2019 hit a startling new high, a big problem that saw some of the largest trucking companies go out of business.

Close to a staggering 800 trucking companies went out of business in 2019 alone. Trucking company bankruptcies saw big players such as New England Motor Freight (NEMF), Falcon Transport, Carney Trucking Company, LME, and ALA Trucking go out of business. And in what seemed like a crescendo, the largest trucking company bankruptcy in history came hard and painfully on December 10, 2019.

After a few days of a bankruptcy rumor spreading around, Celadon announced it was filing for Chapter 11 bankruptcy and ceasing operations.

Celadon was best recognized for its over-the-road service and had close to 4,000 employees, about 3,300 tractors, and 10,000 trailers—without doubt, the largest truckload carrier in North America.

It is no wonder insiders declared 2019 a “bloodbath” year for the trucking industry.

The 2019 trucking company bankruptcies were a massive jump from the 310 trucking companies that halted operations in 2018. Surprisingly, the fails came after a 27-month long bullish run of annual increases, and a 20-year low in the number of trucking companies.

Why Are Trucking Companies Filing for Bankruptcy?

Understanding what’s causing the bloodbath is vital to highlighting the reasons many trucking companies went under in 2019.

In a press release, Celadon’s CEO said it had encountered three problems:

- Costs associated with its accounting scandal and multiyear investigation, which cost them up to $60 million

- A huge $391 million debt against $427 million in assets as of December, 2019.

- “Enormous challenges in the industry.”

The company did not give more details on what those enormous challenges were.

What Could Those Challenges Be?

And are they the same reasons other trucking companies are going bankrupt?

We researched and found some of the major ones to watch out for and save your trucking business.

1. Harsh Pricing Environment Hit Hard

The Cass Truckload Linehaul Index measures truckload carriers’ per mile pricing. In July 2019, for example, it showed trucking rates slumped 0.1% compared to the previous year.

Then the index showed quite some stagnation in 2019, especially between mid-May and mid-October as shown below:

Source: Cass

Cass and Broughton Capital reported 2018 closed off at 144.2, a 7.2% annual increase, to record the highest realized pricing for truckload since 1980. Now, compare that to 2019’s chart below and you can notice the near-free-fall in the Cass index throughout the year:

The 2019 realized pricing for truckload was 135.50, a -3.3% drop year-over-year, according to Cass.

Also, the spot market, which refers to shippers booking last-minute transportation and is a boon for both small and large truckload carriers, slumped significantly as well.

Unlike the big players, most small freight companies rely on a thriving spot market.

So, many of the trucking companies that had positioned themselves to reap from reasonable spot prices, encouraged by the highs of 2018, found themselves struggling when spot prices dropped. Speaking to the Wall Street Journal, Echo Global Logistics LLC CEO, Doug Waggoner, cited an oversupply of trucks as the reason for the reduced spot freight and subsequent dramatic drop in trucking rates in 2019.

2. Reduced Demand Hence Low Truckload Volume

Donald Broughton, a managing partner at the data firm Broughton Capital, told Fox Business that slowdowns in the auto and housing markets, as well as trade tariffs, led to the slump in volume in 2019.

As early as March 18, 2020, the Cass Freight Index was showing a trucking recession in the making, when February recorded a 2.1% drop in freight shipment volume across all transportation modes in the U.S.

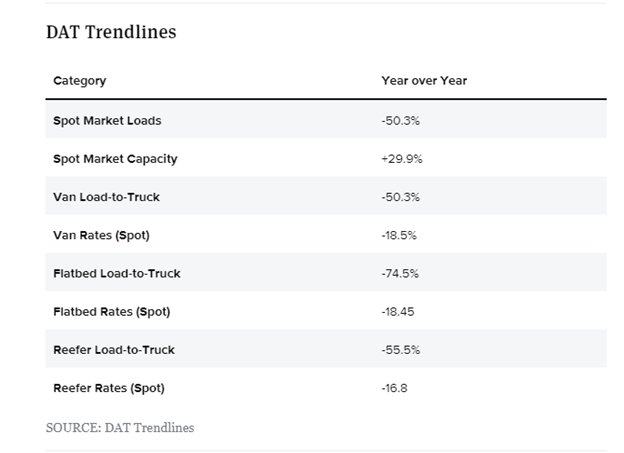

DAT also reported dramatic drops in load volumes across all trucking modes as shown below:

Reduced demand for freight services meant operators were unable to pay off debt, service their rigs, pay drivers, and other staff, as well as invest in trucking technologies to boost their efficiency in 2019.

3. Increased Costs Made It Even Tougher to Compete

After a great run in the previous 27 months, many trucking companies spend a lot on buying equipment, including big rigs that lead to the oversupply of capacity and drop in spot market rates.

There were more concerns:

- Insurance costs also went through the roof.

For example, HVH Transportation Inc. reported paying a $368,000 insurance bill in 2019. It was a huge jump, considering it had paid $150,000 the previous year.

- Driver compensation increased

Freight companies paid drivers more in 2019, perhaps to curb runaway-high driver turnover rate. The National Transportation Institute (NTI) reported that shippers “aggressively” increased class A truck drivers wages by about 10% over the previous year, with 20% of shippers doing it more than once in the same year.

4. Low Investments in Trucking Technology

Trucking technologies help smart trucking companies to increase their efficiency levels in all areas of operation, from fuel savings to handling driver shortages.

Companies that invested in their trucking technology, such as FedEx Freight, were not nearly as affected by the trucking industry challenges of 2019 as truckers who did not.

Why does trucking technology matter?

Take using a top trucking app, for example. You can use a smart trucking app to do real-time load tracking, freight matching, route planning, and optimization, as well as use its accurate GPS to shorten distances and save on fuel costs. A smart trucking platform such as TruckBook goes further as a comprehensive trucking platform.

You can hire truck drivers, promote use of Truck Maps among you drivers to save time and money, lease trucks to meet demand, as well as sell trucks to remain flexible.

You can also find spot pricing loads, hotshot gigs, truck parking, and emergency roadside assistance to help reduce downtime and boost your trucking business revenues.

What’s Next?

The American Trucking Association has annually reported massive driver shortages, meaning drivers affected by 2019 trucking company closures are likely to find a spot elsewhere. That’s a good thing.

But trucking companies and shippers will want to note the reasons trucking companies filed for bankruptcies in 2019.

By learning from the failures of others, they can adapt their trucking strategies and integrate trucking technologies such as TruckBook to help them run their businesses much more efficiently.

To avoid the problems that saw trucking companies close down in 2019, you can:

• Find and use more affordable trucks and equipment

• Get drivers to curb runaway wages

• Use the best trucking app to find favorable spot pricing so you can fetch reasonable freight rates

• Use suitable loads and lanes to increase your year-round volumes so you can operate at a profit and be able to clear your trucking company’s debt obligations.

When those aspects are going right, it is much easier to keep debt in check. With low debt levels, it is so much easier to weather most headwinds—even over extended months.

Want to increase your trucking business revenue, truck driver salary, and book the best loads and lanes in the market today? TruckBook is a comprehensive platform for truckers where you can hire CDL drivers, buy/sell/rent/lease trucks, and get insights from the vibrant truckers’ community in the palm of your hands.

Download TruckBook App Now